Estonia has the most advanced digital society of our time. Let's take a closer look at the e-Residency program, which enables the creation and management of a borderless company.

This is a continuation of the series on Flag Theory.

Country Facts

| Article | Fact |

|---|---|

| Population | 1.3 million |

| Quality of Basic Education | Excellent |

| English proficiency | Moderate |

| Average violent crime rate | Low |

| Languages | Estonian, Russian |

| Capital City | Tallinn |

| Average Life Expectancy | 76 years |

| GDP/PPP | USD 29,500 |

Estimates of cost of living

| Items | Monthly expenses |

|---|---|

| Single Student | 857 USD |

| Digital Nomad | 1,183 USD |

| Single retired person | USD 1,684 |

| Retired couple | USD 2,240 |

| Single entrepreneur | USD 2,082 |

| Entrepreneur with family of 4 | USD 3,922 |

Advantages and Disadvantages

| Advantages | Disadvantages |

|---|---|

| e-Residency program | Cold climate |

| Simple tax system | |

| Mature technology platform | |

| Ease of doing business | |

| Nearly perfect banking regulations |

e-Residency - an introduction

e-Residency is a phenomenon where a person can easily become a digital resident. However, it is important to mention here that this does not lead to "regular" Citizenship in Estonia.

A regular residency allows you to physically live in a country and trade with the people of the society. In addition, such residency allows you to acquire valuable assets. You can even get a second passport if you live there and meet the requirements for a passport if you come from another country.

The Estonian e-Residency program, on the other hand, allows you to be a citizen of Estonia only in the digital sense. Your physical citizenship is not considered under the program, and you must follow the usual legal procedure if you wish to acquire actual citizenship instead.

So what are the possibilities of the e-Residency program?

Once you get a profile in e-Estonia, you can immediately start using the services of the government and the Internet will be your means of commuting. Also, things like opening an online bank account are quite easy since you are already validated by the government of e-Estonia. Moreover, currently any e-resident can start and manage an online company without having to go through many tedious procedural steps.

In short, you have the opportunity to:

- Establish and manage your Estonian company online.

- Open and perform online banking

- Contact payment service providers online

- File Estonian taxes digitally

- Transfer money remotely

- Encrypt and send documents

- Verify documents for authenticity

- Sign contracts and documents digitally

Grow your business

Since Estonia does not provide for corporate tax on reinvested profits, you can accumulate profits tax-free (e.g., you can also distribute profits to shareholders, subject to a 20% corporate tax rate, described later).

A hypothetical example of how good this actually is for growing your business:

A company has annual income of $1 million. If we compare the federal corporate income tax in the US (35%) with the tax not levied in Estonia, we get the following figures:

| 1st year | 2nd year | 3rd year | 4th year | 5th year |

|---|---|---|---|---|

| Estonia based company | USD 1,000,000 | USD 2,000,000 | USD 3,000,000 | USD 4,000,000 |

| Company headquartered in the USA | USD 650,000 | USD 1,300,000 | USD 1,950,000 | USD 2,600,000 |

| Difference | USD 350,000 | USD 700,000 | USD 1,050,000 | USD 1,400,000 |

If you keep this in mind, you can save a lot of money by maximizing tax efficiency in a growth phase.

Estonian tax system in detail

According to the International Tax Competitiveness Index, Estonia has the most competitive tax system among all OECD countries. As I said earlier, Estonia levies a meager 20% tax compared to the U.S., and only on distributed profits. In simple words, every corporate income is taxed once, and there is no individual tax on dividends in Estonia. No corporate income tax is levied unless a company plans to distribute its profits as dividends to its owners.

Most countries have a system that taxes corporate profits twice. The first tax is levied at the corporate level, while the second tax is on individual dividends. In America, 56.6% of the integrated tax is levied on corporate profits. Therefore, citizens of the UK, Canada and America, for example, can benefit from double taxation treaties using the extensive Estonian tax network.

Another - more complex - example.

An Estonian company has decided to distribute €10,000 from its profits to a tax resident in Germany; the tax is to be broken down as follows.

- €2,000 tax to be paid (corporate income tax on distributed profits)

- 25% tax on the €8,000 of capital gains left by the German and on €2,000 likewise

- €6,000 is available to the individual after taxes.

However, if the resident is from a nowhere country or a country with a territorial tax system such as Panama, only 20% Estonian corporate income tax is paid. An additional advantage is that an Estonian company also gives you the opportunity to be present in the European Union through your company.

Application for e-Residency

You must be at least 18 years old and have no criminal record. The background check is done by the Estonian police, so you can relax. With an application fee of €100, you can click here to apply.

After that, you can get your personal Estonian digital ID card at any Estonian consulate. The approval process should take about 2 months (but it can be much faster). With adequate coverage in North America and full coverage for Europe, you can easily use your ID card in these countries.

How to establish a company in Estonia and open a bank account?

Any foreigner can establish a legal entity by paying approximately €2,500 and immediately owning a limited liability company. Once the amount is paid, all liabilities are automatically discharged. The Estonian government will help you understand the rules and regulations.

These basic steps will help you understand how to register a company as an e-resident.

- get an address in Estonia for your business. The numerous service providers will help you with this.

- register your company online through the company registration portal (easy method without a notary) or again use a service provider.

You can open a bank account after you have successfully registered your business. Currently, an e-Resident can meet a bank employee via secure video chat and apply for a bank account, while there are still some banks like LHV that require a one-time on-site presence. Nevertheless, this has some advantages you can compare here.

Requirements for the right to manage the company.

To obtain the right to manage your company, you must meet the following requirements and submit these reports.

- statement of changes in shareholders' equity

- cash flow statement

- profit and loss statement

- financial position in the form of a statement

Every accountant in a company knows how to prepare these financial statements and reports, and even if your company does not have an accountant, the Estonian government will help you with its e-financials software designed for tax returns. The software also helps you manage your books and prepare the required quick financial statements.

Comparison of business entities

All business entities can be distinguished mainly by these characteristics:

- Share, scope and principle of shareholder liabilities.

- Requirements for the audit of the company

- Required amount of share capital along with contribution funds

- Right of presentation of the company

- Decision-making processes and management bodies of the company

- Simplifications in the organization of daily work.

| Form of enterprise | Minimum required start-up capital (EUR) | Minimum required number of founders | Financial liability | Management |

|---|---|---|---|---|

| Sole proprietor (FIE) | none | 1 | Unlimited liability | No management bodies |

| Private limited company (OÜ) | EUR 2,500; none if the share capital does not exceed EUR 25,000 | at least 1 | Shareholders are not personally liable for the liabilities of the OÜ | The mandatory management body of the OÜ is the management board; a supervisory board is only mandatory if specified in the articles of association. |

| Public limited company (AS) or | EUR 25,000 | at least 1 | Shareholders are not personally liable for the liabilities of the stock corporation | The supreme governing body of the stock corporation is the shareholders' meeting; a stock corporation must have a management board and a supervisory board. |

| General partnership (TÜ) | none; amount of contribution is determined in the partnership agreement | at least 2 | Unlimited liability for the partnership's liabilities is borne by the partners in equal shares | no mandatory management bodies |

| Commercial association (UÜ) | none; amount of contribution is specified in the partnership agreement | at least 2 | At least one general partner has unlimited liability for the partnership's obligations; at least one limited partner has limited liability in the amount of his contribution | no mandatory management bodies |

| Commercial partnership (ühistu) | EUR 2,500 | at least 2 | The partners are not personally liable for the liabilities of the commercial partnership, unless otherwise agreed | The general meeting is the supreme body of the partnership; decisions are made by voting, with each member of the partnership having one vote. The board of directors is the governing body of the society. |

Services and goods of a foreign company can be offered in Estonia also through a branch office. The company's branch office must be registered in the e-Business Register. However, it should be noted that a branch is not a business entity and the foreign company is liable for the obligations arising from the activities of the branch.

Required procedures for registration of an OÜ or AS.

- Determination of the legal form and name of the company

- Selection and appointment of directors, owners and founders of the company

- Determination of the authorized capital

- Drawing up the company's articles of association

- Determination of e-mail, telephone and address

- Signing the incorporation documents before the notary public

- Opening a bank account in the name of the company

- Issuance of the B-card (registration certificate) of the company by the Estonian Trade Register

- Signing of the agreement on the use of the electronic services of the Tax and Customs Administration

- Obtaining, if necessary, a license to carry out special activities by registration in the e-Business Register

Current status of banking transactions

As you have already learned, as an e-Resident you can start a business in Estonia after receiving your DigitalID, but you can also pay taxes and do remote accounting from anywhere in the world.

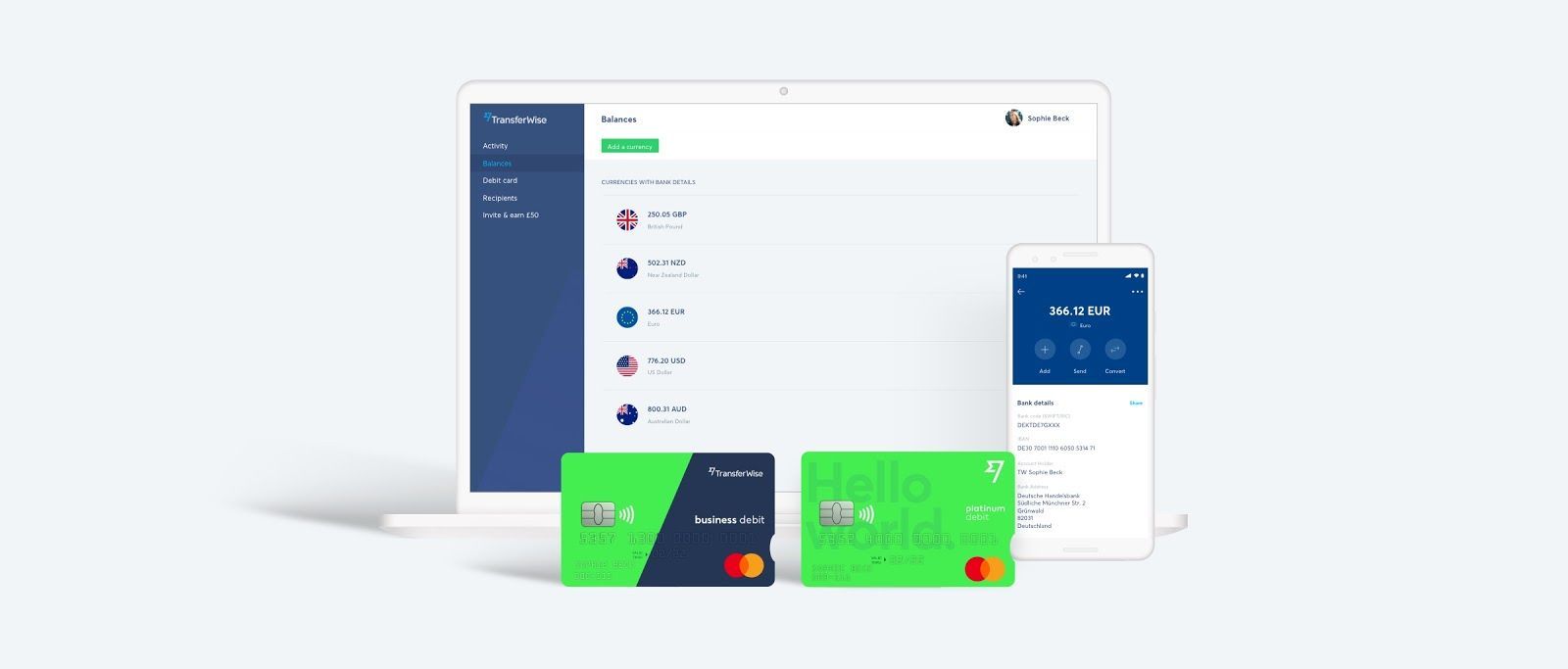

Since January 2019, you can deposit your company's registered capital from anywhere in the world using any acceptable electronic payment method, including [Wise] (https://transferwise.com/invite/u/axelq2). So you are no longer tied to making the transaction from a real bank account in Estonia. This move by the Estonian government has made it very easy to get started with e-residency and has made it even easier to do business.

For a PSP (IBAN) account that allows you to receive and send money, using Wise is a seamless solution and you can open the account remotely. I will provide more information about the institution in another article.

Final Thoughts

According to Tax Foundation, Estonia's tax system is the most competitive in the world. You can grow your business through the profit you generate, because - in its most extreme form - there are no taxes, so your business can grow unhindered.

With literally no bureaucracy, you can do business from anywhere in the world with ease. Your digital presence and signature allow you to start, run and grow a business while gaining access to the European market - all for a common equity investment of around €2,500.

Recommended Literature

- The e-Residency Program Of Estonia: Launch and run a location independent business 100% online; Ignacio Nieto Carvajal (Self-Published)

- Daylight Robbery. How Tax Shaped Our Past and Will Change Our Future; Dominic Frisby (Penguin)

The website and the information contained therein are not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained on this website do not constitute investment advice.